When the COVID-19 epidemic broke out at home and abroad, the global trade volume had dropped sharply so that the demand for containers had fallen dramatically and customers of container became pessimistic. As a result, in the first half of 2020, the container market was in a downturn, and customers generally reduced their purchases of new containers, so container manufacturers mainly digested the orders in 2019 with fewer new orders. And even some of the container manufacturers stopped production.

At the same period, the total global container production and sales volume was about 1.04 million TEU, a new low since 2016. Among them, the production and sales volume of dry containers was 896,000 TEU, refrigerated containers were 1.28 million TEU, and tank containers and others were about 16,000 TEU. In June, with the strong trend of China's resumption of production, container exports began to increase, and existing empty containers in China continued to be shipped out, and container production orders resumed one after another.

When the COVID-19 epidemic broke out at home and abroad, the global trade volume had dropped sharply so that the demand for containers had fallen dramatically and customers of container became pessimistic. As a result, in the first half of 2020, the container market was in a downturn, and customers generally reduced their purchases of new containers, so container manufacturers mainly digested the orders in 2019 with fewer new orders. And even some of the container manufacturers stopped production.

At the same period, the total global container production and sales volume was about 1.04 million TEU, a new low since 2016. Among them, the production and sales volume of dry containers was 896,000 TEU, refrigerated containers were 1.28 million TEU, and tank containers and others were about 16,000 TEU. In June, with the strong trend of China's resumption of production, container exports began to increase, and existing empty containers in China continued to be shipped out, and container production orders resumed one after another.

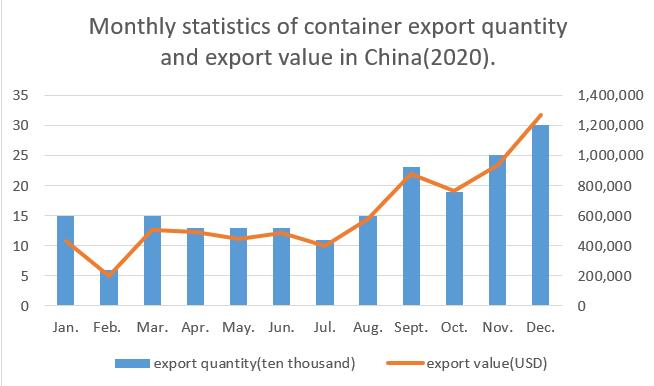

In the second half of 2020, China's economy took the lead in recovery of exports trade. China had become the most stable link in the global supply chain system with the demand for export containers increasing rapidly. But lower operating efficiency at overseas ports due to the epidemic makes it difficult to ship empty containers back to China, resulting in the one-way flow of containers from China to overseas.

Imbalanced import and export trade, reduced container turnover efficiency and other factors, resulted in the shortage of export containers in China, especially the serious shortage of 40HQ containers. In July 2020, driven by the demand of downstream transportation, container orders began to increase continuously and in October, container exports began to show explosive growth.

Data source:General Administration of Customs.

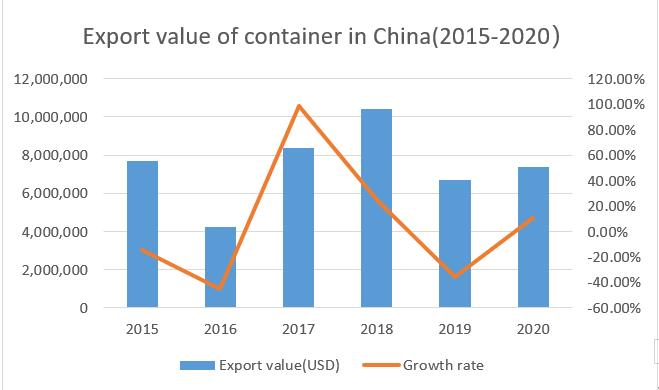

The demand of container export market was still at a low level. According to the statistics of China Customs, the number of container exports in China in 2020 was 1.98 million, down 18.2% from the previous year, but the decline rate was obviously narrowed compared with the previous year. In 2020, the export value of containers was US $6.685 billion, up 10.2% over the previous year. According to the analysis of the number of container export markets in recent years, the container export market was still at a low level in 2020, the number of container exports has reached a new low in five years, but the unit price of container export has increased, and the export value has increased compared with the previous year.

Data source:General Administration of Customs.

Data source:General Administration of Customs.

The domestic market demand is more vigorous. In 2020, with domestic multimodal transport maintaining rapid development, the business of "shipping bulk goods by containers" was further expanded, and the domestic market demand for containers was further expanded too. According to the analysis of market research data, the domestic container market accounted for 14% of the total container sales in China, an increased of 4.4 percentage points over the previous year, showing a rapid growth trend. Domestic orders for containers mainly came from railway companies and container transport enterprises.

The profit rate of container industry returned to a reasonable range. In 2020, thanks to the country's efforts to ensure the stability of the global supply chain and the continuous stabilization and improvement of foreign trade, the volume and price of container manufacturing had risen together, and the profitability of enterprises has improved.

According to industry research, in 2020, the profit rate of major container manufacturers was between 3% and 8%, and the profit level remained in a relatively reasonable range. Strong and rapid demand for containers had pushed up container prices and the profitability of the industry.

Source: Annual Report on China Container Industry and Intermodal Development 2020.